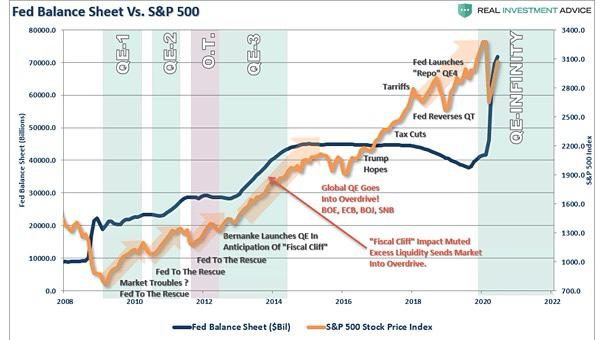

Central Bank led Bull Market

When was the last time you had growing bad news coupled with market highs in Equity and Gold….all at the same time? Indian Stocks are at the highest level since the fall in March with the US markets are at lifetime highs. The joke going around is there are more people waiting for the market to correct today than there are investors!!

“The influences on stock prices are so numerous and so complex that no person has ever been able to predict the trend of stock prices with consistent success” John Templeton

So why have the markets gone up? The markets have gone up globally due to Liquidity. Money flow is usually more powerful than economic forces.

The stimulus in the west is a mega US$ 3 Trillion and even a small per cent of this trickling down to Indian markets pushes our markets ups. Even 1% of this stimulus translates to Rs 200K Crores, 2x the amount that left the Indian Markets in March 2020.

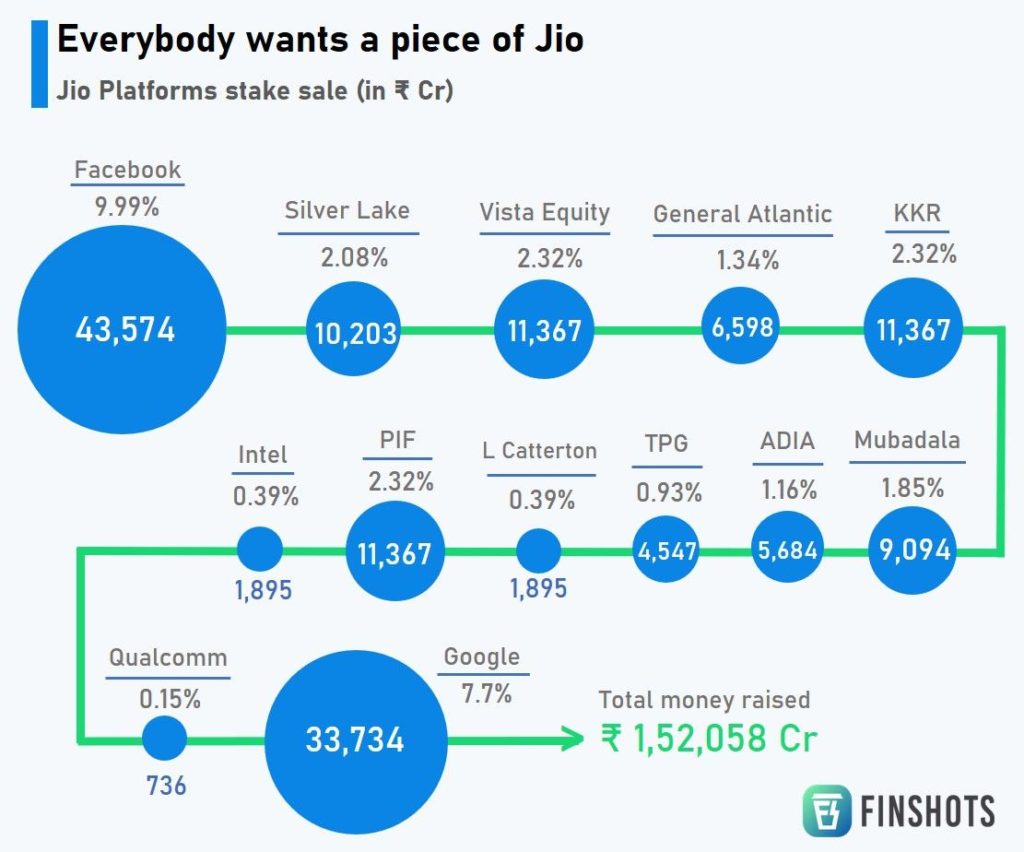

Added to this has been the investment inflow led by Reliance

Reliance raised amounts in excess of Rs 150K crores from FB, Google and many other investors. When the going gets tough, the tough do get going! Reliance Share is up 2.5x since its March low.

With its weightage being 14% of Nifty, you can see the impact on the stock market!!

Where are the markets now?

The Market Cap to GDP in the US is at an all-time high of 200% while in India it is closer to its average of 75%.

Another metric is to look at the Price – Earnings (P/E) multiple. The P/E based on FY 21 earnings has hit a 15 year high of 21, which is 34% higher than the long term average of 15.2, even though Nifty earnings are expected to fall by 10% for the year. Historically, whenever the Nifty peaked at a one-year forward P/E of 18.5-19.5, it failed to generate returns in the next twelve months.

What does all this mean to the future?

The key here is to understand that no one knows what a central bank-led bull market looks like. This coupled with very low-interest rates are pushing investors to better returns which only one asset class can give – Equities.

While one can never predict the moves in the market, one can prepare with proper planning. The key at these times just like it was at every crisis is to focus on Asset Allocation. We believe the markets will provide opportunities over the next few months and we should be deploying investible corpus to take advantage of this opportunity.

Source: Capitalmind, Finshots, Economic Times & Moneycontrol

#investing #volatiletimes #FOMO #banconus

Leave a Reply