Market Musings Week 21: All time Highs

Equity benchmark Nifty50 stormed to lifetime highs at 15469 on Friday, encouraged by the rapidly ebbing second wave. Fresh infections, although still high, have come down quite a bit. Fresh cases have dipped to 1.75 lakh during the last 24 hours while global cues with rise in jobs in the US added support to our markets.

Even the RBI in its annual report stated that the costs of the second wave, under its best scenario, could be limited to the first quarter of 2021-22, possibly spilling over to July. However it did add, ‘This is the most optimistic scenario that can be envisaged at this juncture – it provides a limited window to establish strict pandemic protocols and logistics, ramp up vaccines production and medical supplies, fill gaps in the health infrastructure and build up stocks, especially of vaccines, in preparation for the next wave of infections. In all other outcomes, losses in terms of lives, employment and output are likely to be adverse and long lasting.’

In short, there’s still plenty of uncertainty and we should keep our eyes on inflation and the interest rates. The ECB has warned of ‘remarkable exuberance’ while the RBI has also warned of a bubble in the making. The markets have however, ignored it, as the RBI has been warning of this bubble since the Nifty was at 8000 levels!!

There is no doubt that growth is roaring back in most developed economies and whether India will also recover similarly, is anyone’s guess.

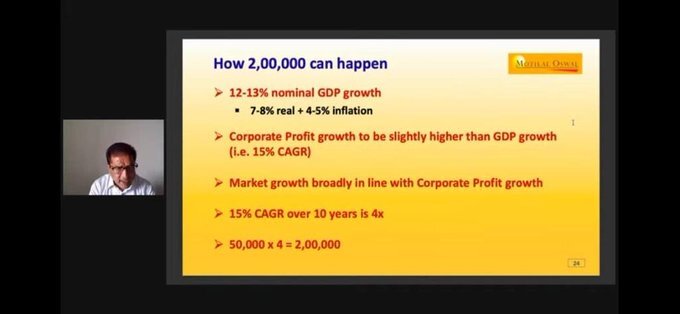

Talking about guesses, here is a prediction by ace investor Raamdeo Agarwal.

“In the last 10 years, the S&P BSE has given a modest CAGR return of 10 per cent – from 19,445 levels in March 2011 to 49,509 levels in March 2021”, Agrawal said. During this period, market has taken crises like demonetization, the ILFS fiasco and Covid in its stride. During this period, the Indian economy, according to him, has grown at a CAGR of 4 per cent – from 1.7 trillion in 2010 to 2.6 trillion in 2020E, as compared to China that has grown at 10 per cent CAGR to 13.2 trillion in 2020E. By 2029, he expects the Indian economy to reach the $5 trillion mark.

I’m not good in predicting the future…all i know is a proper asset allocation aligned towards goals and the behavioural aptitude to withstand volatility will stand in good.

I leave you with a lovely video i saw on Finkrypt’s twitter that shows the varying constituents of Nifty over the years.

Source: Moneycontrol, Finkrypt, Business Standard

Leave a Reply