Markets Moves reinforce the need for Asset Allocation

Markets have been running up distinct from the ground reality as I have been writing and talking about. The markets seem to have gotten a dose of reality and perhaps suffered some self-doubt! Indian market Index Nifty touched 11600 mid-September and corrected to 10800 before climbing past 11000 this Friday. Globally, the Nasdaq and tech stocks have corrected by over 10% since its peak early September, while the broader S&P 500 has corrected closer to 9%.

I’m sure you would have seen various reasons given for this – economic recovery is plateauing says one article, while another points to fresh COVID-19 cases. US PMI is fine but Eurozone is stalling said another…and, of course, there is always the US presidential election to blame.

What should investors do? Answer is obvious….NOTHING!

Please take a look at my recent video where I talk about 2 stories that reiterate some key Investment Principles. Movement in stocks will happen daily but one should ask the question….what are we buying? Good businesses or Stock prices??

Also don’t forget to check out the video on Asset Allocation by Rajee, where we delve deeper into this important concept. If you want to know what Asset Allocation is all about, again, do check out our FB Page where our series called “Money Mantras” elaborates its key components.

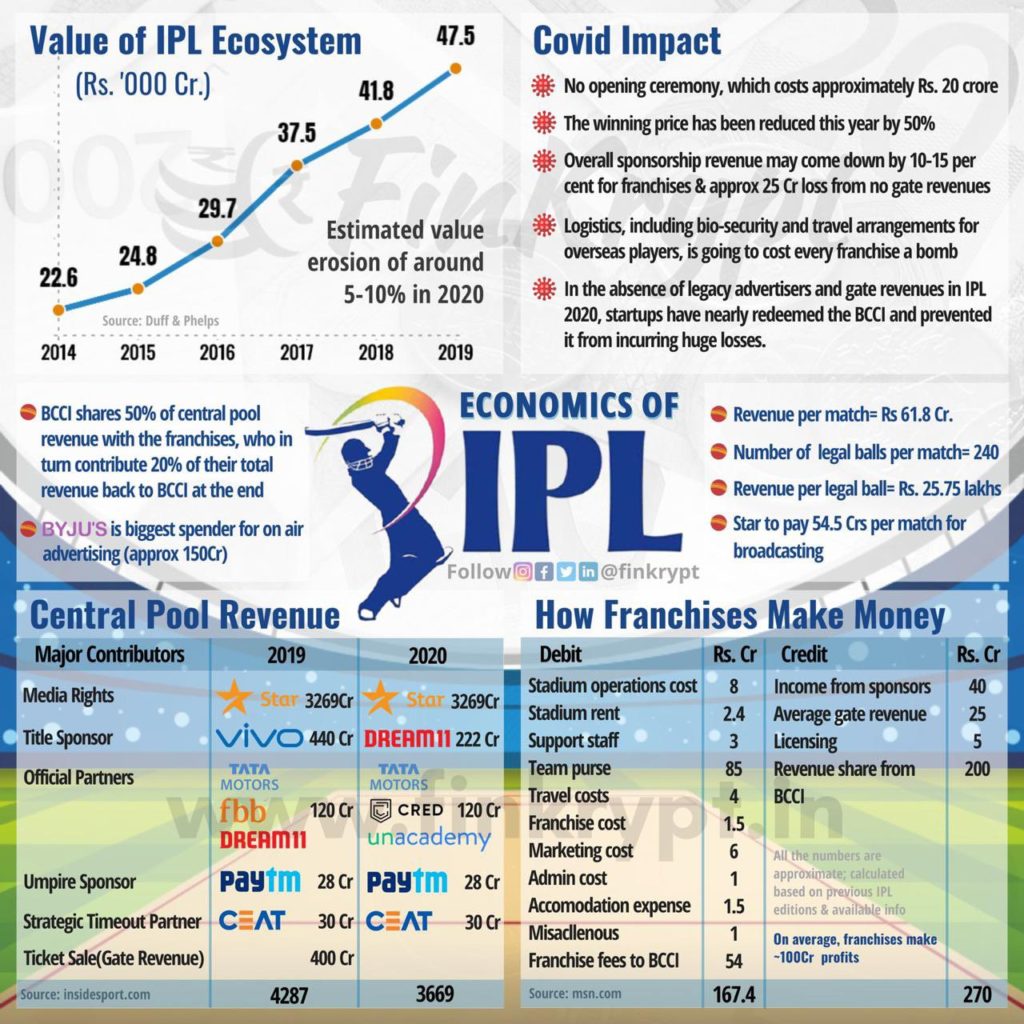

While markets might move up and down, one thing where interest hasn’t ebbed by much is IPL!! IPL fever has started late and is keeping many of us engaged. I saw this interesting infographic on the value of IPL.

Leave a Reply