Market Musings Week 20: Crypto Crash

On 22 May 2010, a software developer Laszlo Hanyecz agreed to pay 10,000 Bitcoins for two pizzas. He used 10,000 bitcoins to purchase roughly $41 dollars back in 2010, and is widely viewed as the first time a virtual currency had been used to buy anything in the real world. Even after the tumultuous week, 10,000 bitcoins BTCUSD, -4.79% would be valued at approximately $380 million at the current rate for the world’s most prominent crypto, which was last changing hands at roughly $38,000 on CoinDesk on Saturday.

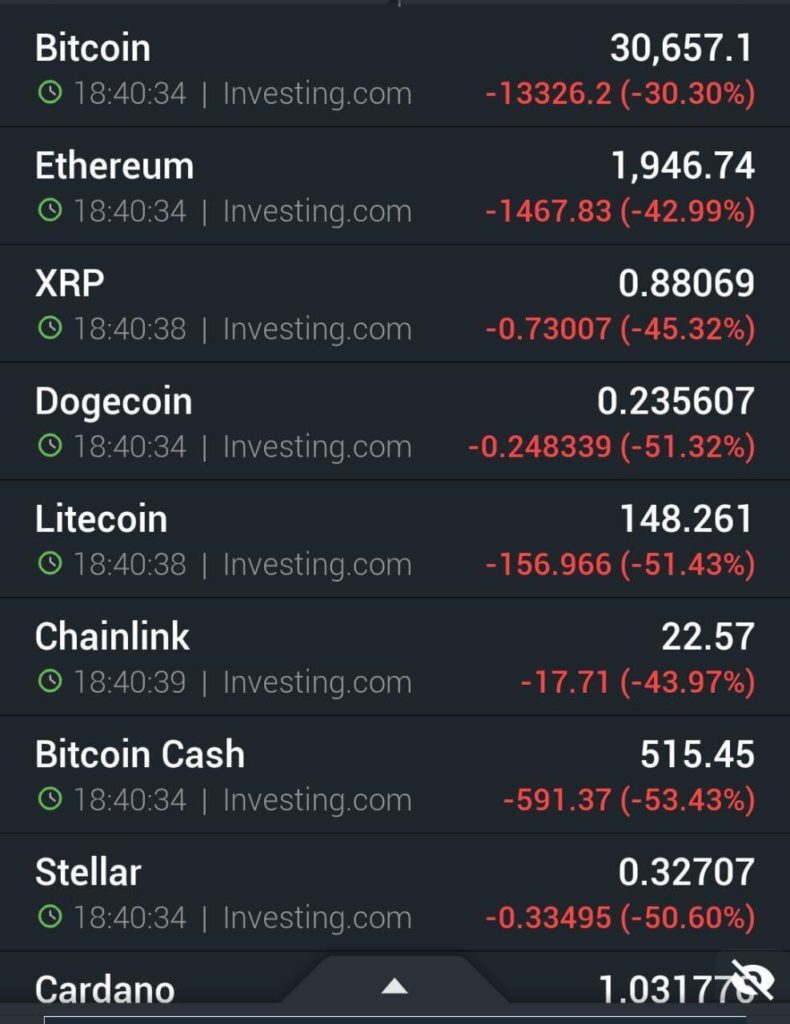

Cryptocurrency is far from being used as regular money, thanks to its wild volatility. Imagine selling your house for Bitcoins only to find that its value has fallen 30% the next day! Stability is essential for cryptocurrencies if they are to act as a unit of account and a medium of exchange. Questions about how countries will tolerate the rise of crypto remain. Bitcoin and its ilk have been pummeled by reports that China will aim to crack down on digital assets. And a statement by the U.S. Treasury Department, noting that it will look to enforce anti-money-laundering rules for bitcoin transactions of $10,000 or greater has dented enthusiasm in the sector.

Ultimately, Bitcoin Pizza day is being used by some crypto bulls as a time to reflect on how far blockchain-based assets have come and how far they might still have to go to achieve further legitimacy.

This is what happened on one day in Cryptocurrencies. If you are planning to invest, you have to ask this question : “How would you react were your holdings to fall by this much in one day, because of a Tweet?” Remember investing is NOT about money alone but more about behaviour!

It’s unclear where bitcoin goes from here. But much like the character Neo in “The Matrix,” many crypto bulls are saying that they “didn’t come here to tell you how this is going to end,” they are here to “tell you how it is going to begin.”

In the meantime, Indian stock markets recorded their biggest weekly gain since the Budget week; both Sensex and Nifty gaining close to 4%. The markets are buoyant, because the number of COVID cases is coming down and the economy is bound to bounce back over the medium term just like it did after the first wave last year.

Source: Marketwatch, Moneycontrol

Leave a Reply