Market Musings Week 24: Monsoons and lower COVID cases

The Southwest monsoon has begun in Mumbai and this should bring relief from the hot summer. The COVID cases count is also reducing with the 7 day average just above 50K. The Indian markets remained flat this week while the S&P 500 was down 2%.

The US Fed remained calm in the face of rising inflation and stuck to its narrative of inflation being transitory. Even back home, rising inflation hasn’t pushed RBI to change its stance as it continues to support growth. As Moneycontrol puts it, a new period of volatility lies ahead and the Fed’s actions will be guided by data, such as on inflation and growth. So investors should also pay closer attention to it.

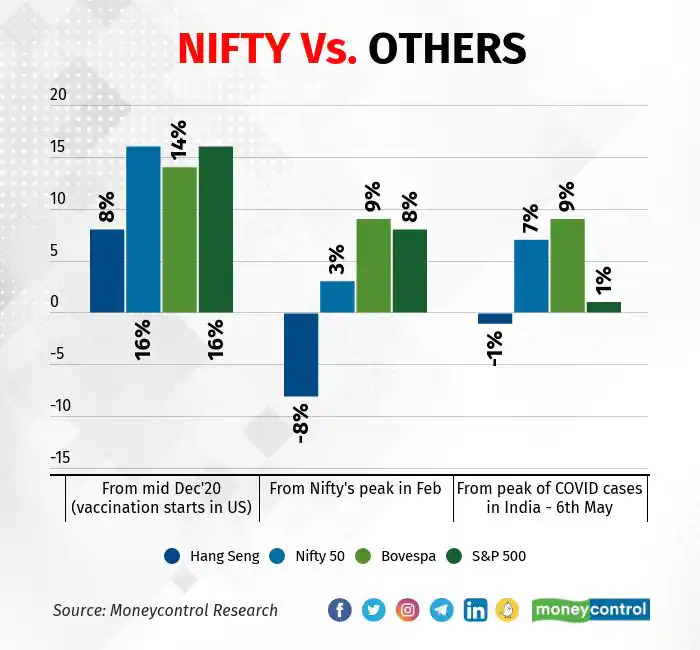

Coming to the Indian markets, the Nifty has outperformed S&P 500 since the time the second wave peaked in India, thus reversing the underperformance in the earlier part of the year. Nifty has run up 12% YTD and some underperformance should be expected in the immediate near term. On a lighter note, you know the investors are doing well when you see newspaper ads, such as the one on top!

What does it mean for Investors?

One cannot worry about short term moves nor can one predict it. As investors, please keep your eye on your goals and how the assets are allocated.

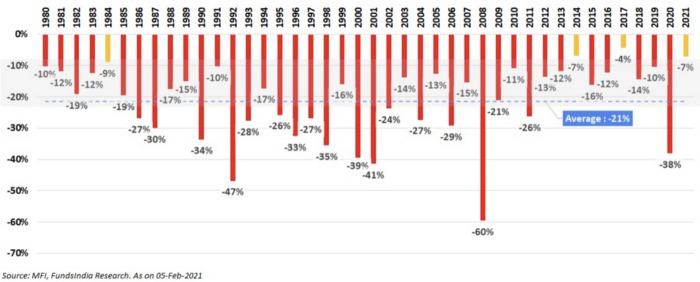

Markets correct 10-20% every year….yes, every single year in the last 40 years.

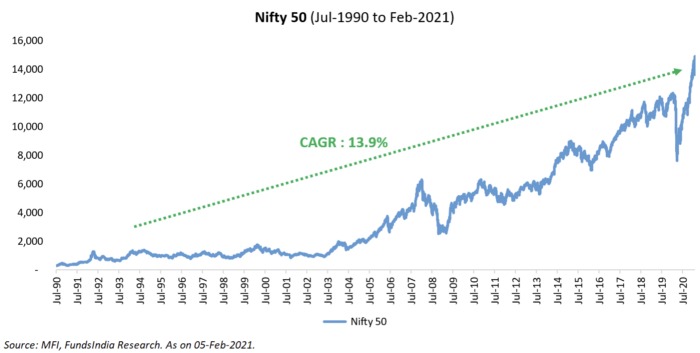

And yet since 1990, patient investors have made 14% CAGR excluding dividends. It’s clear if you sign up for this journey — it’s going to be a topsy-turvy ride but who really wins?

The person who invests & holds. Period.

Source: Moneycontrol, Twitter

Leave a Reply