Market Musings: Week 28 Zomato IPO adds to the frenzy

The Markets are almost at all time highs again, even though they have remained flat over the past month. Key metrics every one is looking at are Inflation and Industrial Production. The headline retail inflation in June was at 6.26%, almost equal to that in May. The good news is that inflation fell month-on-month across the board. What about growth metrics, you ask. The index of Industrial Production (IIP) for May dropped by 10% from April. According to Moneycontrol, the mining sector was hardly affected, while manufacturing took a hit. The industries that suffered the most were consumer durables (this includes passenger vehicles), capital goods and infrastructure. Consumer non-durables, which include FMCG products, did not suffer much and consumption of essentials was relatively unaffected. Thus, while the recovery momentum may have dulled during the June quarter, the damage is not severe.

Zomato IPO

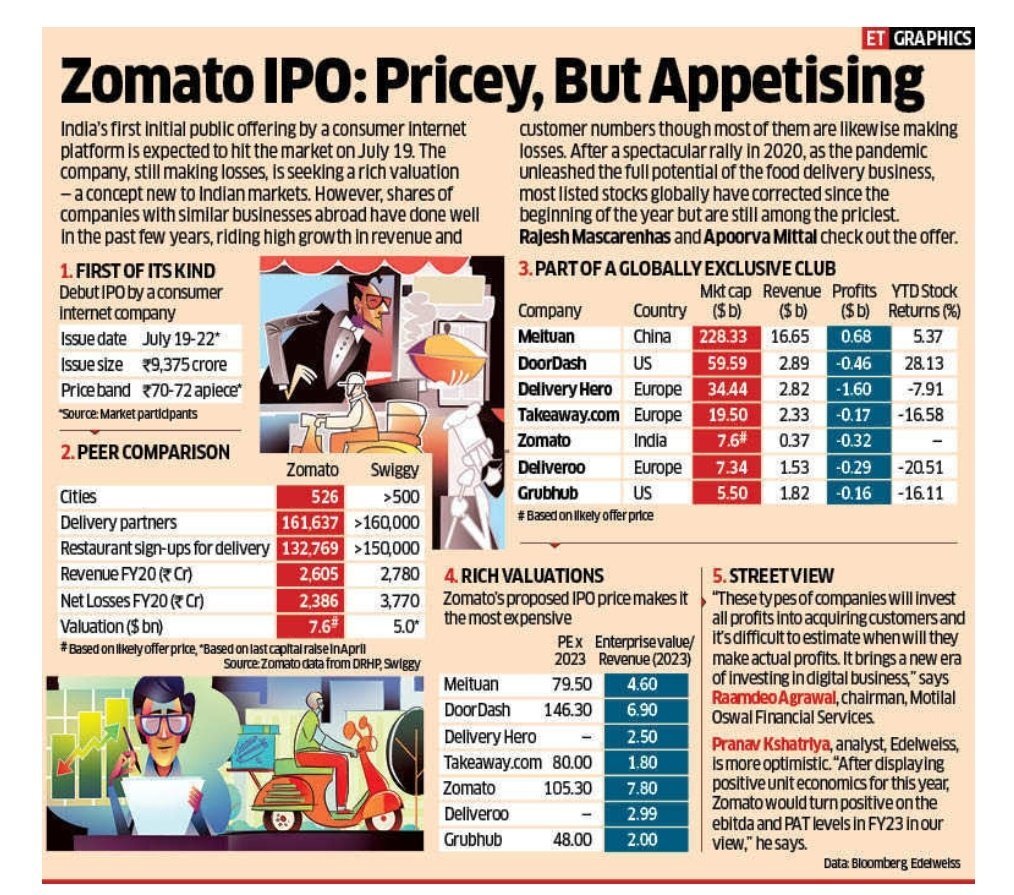

Zomato, India’s leading online food delivery company is raising Rs. 9,400 Crores through an IPO. This values the company at close to Rs. 60K crores, which should make it one of the most expensive company in its sector. According to Moneycontrol, its pre-pandemic EV to sales of 23x, is at a premium over its global peers such as Meituan (21.8x) and DoorDash (18.6x) but below Just Eat takeaway & Delivery Hero!! Clearly the market is quite gung ho about this IPO; retail sector got fully subscribed within an hour and close to 180 Mutual funds have already expressed interest!!

Leave a Reply