Market Musings – Week 1 2021

What a start to the first week in the Markets? Nifty continued to go up -scaling 14300 (up 3% YTD), going from one all time high to a fresh one. Even the storming of the US Capitol by Trump supporters didn’t dampen the spirits. Dow ended up 3% YTD.

Why are the markets running so high?

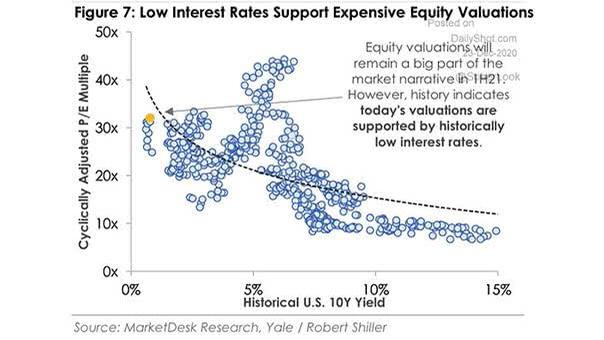

Every bull run has its own reason and they are usually different from different sectors/industries performing well. When I started my investing journey 3 decades ago, it was Harshad Mehta. Then in a few years, FIIs were allowed and then it was Tech Boom in the late 90s. Infra was the theme in the early 2000s and then BJP victory in 2014 with global liquidity drove Consumer Durables, Banking and metals. This year low-interest rates and governments acting as a backstop have unleashed liquidity and markets are usually high during these times.

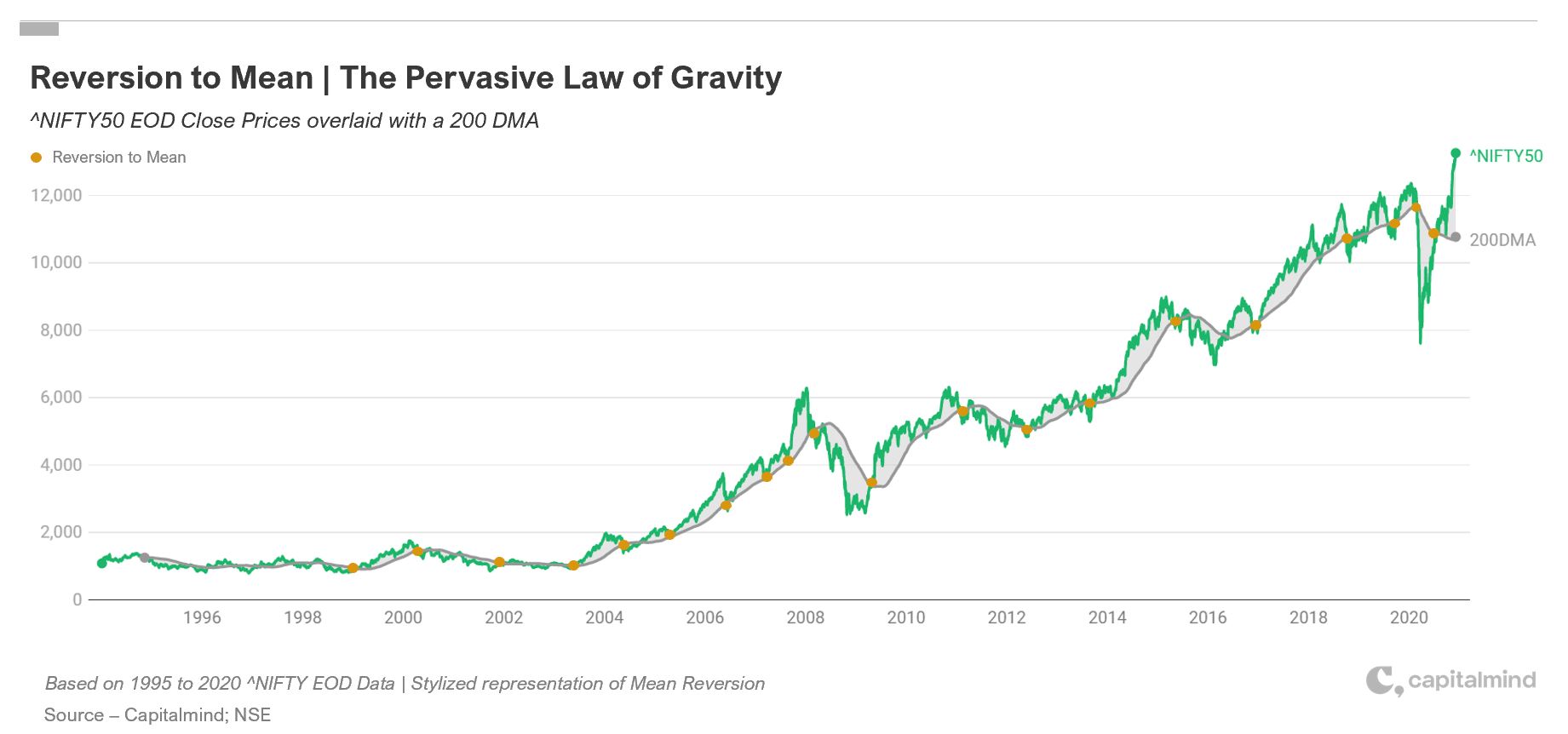

Everyone wants to know when the correction will come. Are we at the top? If only we can guess!! However, we can surely see what history has in store for us. Capitalmind has done this analysis that I share here. To understand this phenomenon visually, here’s NIFTY’s end of day chart since 1995, along with it is the 200-day moving average (DMA).

The price keeps coming back to the 200 DMA. We went down to 35% below the DMA and now we are close to 31% above!! Markets clearly have run fast but when will it correct, and even if it does, by how much….is not something anyone gets right!!

It isn’t just the stock market. Bitcoin hit US$ 40K for the first time ever and separately, Elon Musk became the world’s richest man. I attended a conference a few years ago when one of the world’s leading professors on valuation – Aswath Damodaran was the speaker. He wrote about TSLA being overvalued then and since then the price has gone up 20x. Even as recently as Jan 2020, he exited the stock and since then TSLA has gone up 10x.

Ok, What’s the point, you ask? Even professors who spend their time teaching valuations get it wrong!!

So what can mere mortals do? Focus on the Controllables

Focus on your Behaviour and Asset Allocation. We have done detailed videos on these. Please visit https://banconus.com/behaviour/ and you can learn more.

Rather than predict the market direction, focus on :

- Rebalancing your portfolio, not redeeming

- If you don’t need your money for immediate goals, why exit just because markets are high…do current levels matter 10 years out?

Let money work for you and make 2021 a Profitable year.

Source: Capitalmind, Moneycontrol & Marketdesk research

#investing #banconus #bullrun #predictingmarkets

Leave a Reply