Election Fever

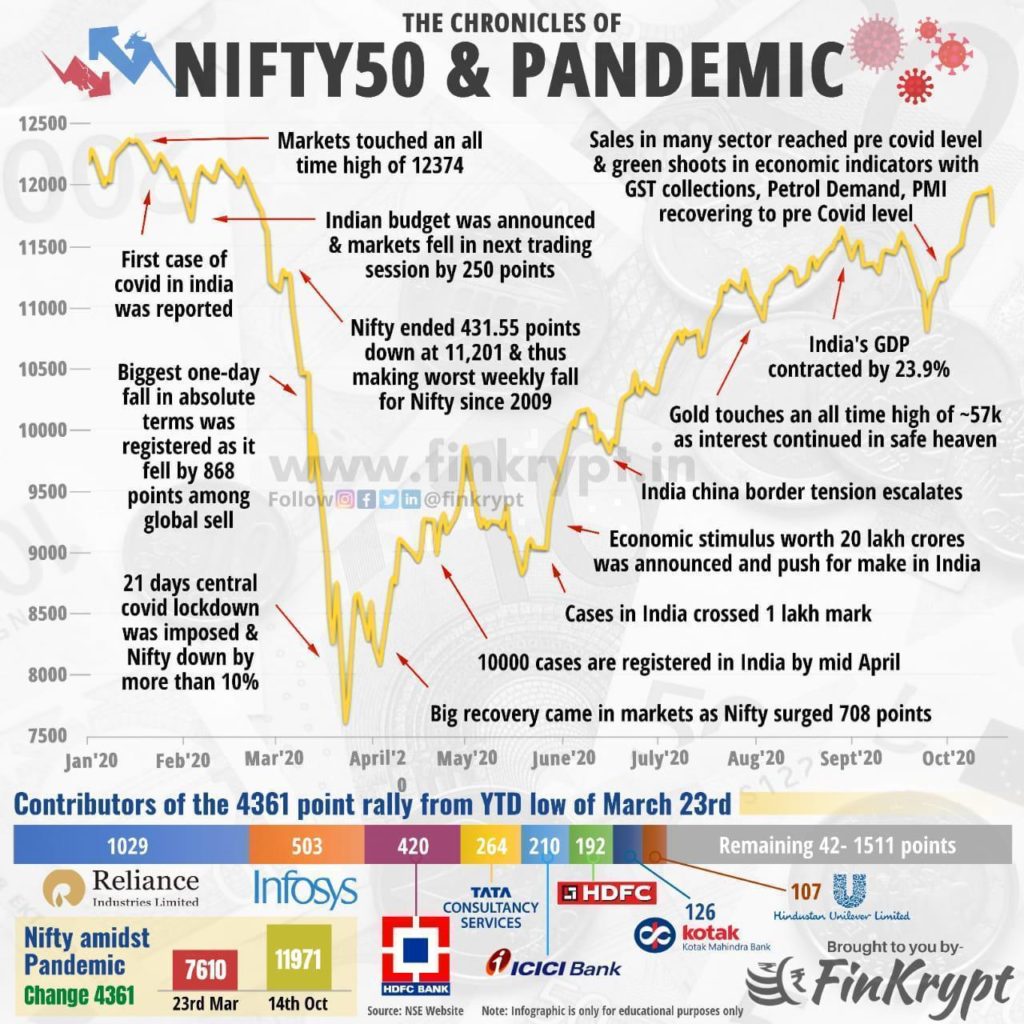

If you have less than a week for elections to the world’s largest economy, surely there is bound to be a lot of noise….as they say, volatility is par for course. The Dow Jones fell almost 6% this week while our own Nifty fell by 2%. Attempts to scale 12000 have failed in October though Nifty did go up by 2% this past month.

You only need to open any news channel to know what the dominant news is…US elections. And this will influence the market sentiment for some time to come. Currently, Joe Biden is the odds-on favourite. He has a sizeable lead over incumbent Donald Trump in opinion polls. In the betting markets, bookmakers have shorter odds for a Biden victory.

Back home, PM Modi gave a rare media interview and he was extremely optimistic about economic recovery. “If you sit among them (pessimists), you will hear only things of despair and despondency,” said the Prime Minister. “Nothing great ever gets done if we get deterred by obstacles in our path. By not aspiring, we guarantee failure,” Modi told the Economic Times.

Moneycontrol analyses this lofty ambition with some stats: When the goal of $5 trillion was announced in FY20, the economy had to grow at a compounded annual growth rate of 11.5 percent to reach $5 trillion by FY25. This is the nominal growth rate; assuming average inflation of 4.5 percent, real GDP had to grow at 7 percent yearly. Now, thanks to COVID, the task has grown much tougher because the economy is set to shrink.

To reach $5 trillion GDP by FY25, the economy has to grow at 17.8% annually in nominal terms. It will be a tremendous achievement to even get close to that number.

With all this noise, I would like to draw our attention to a very interesting chart. How has the Nifty 50 performed since the beginning of the year?

Avoid the noise, focus on your goals and let your money work for you.

Source: Moneycontrol.com, FinKrypt

Leave a Reply