Market Musings Week 13 – New Financial Year

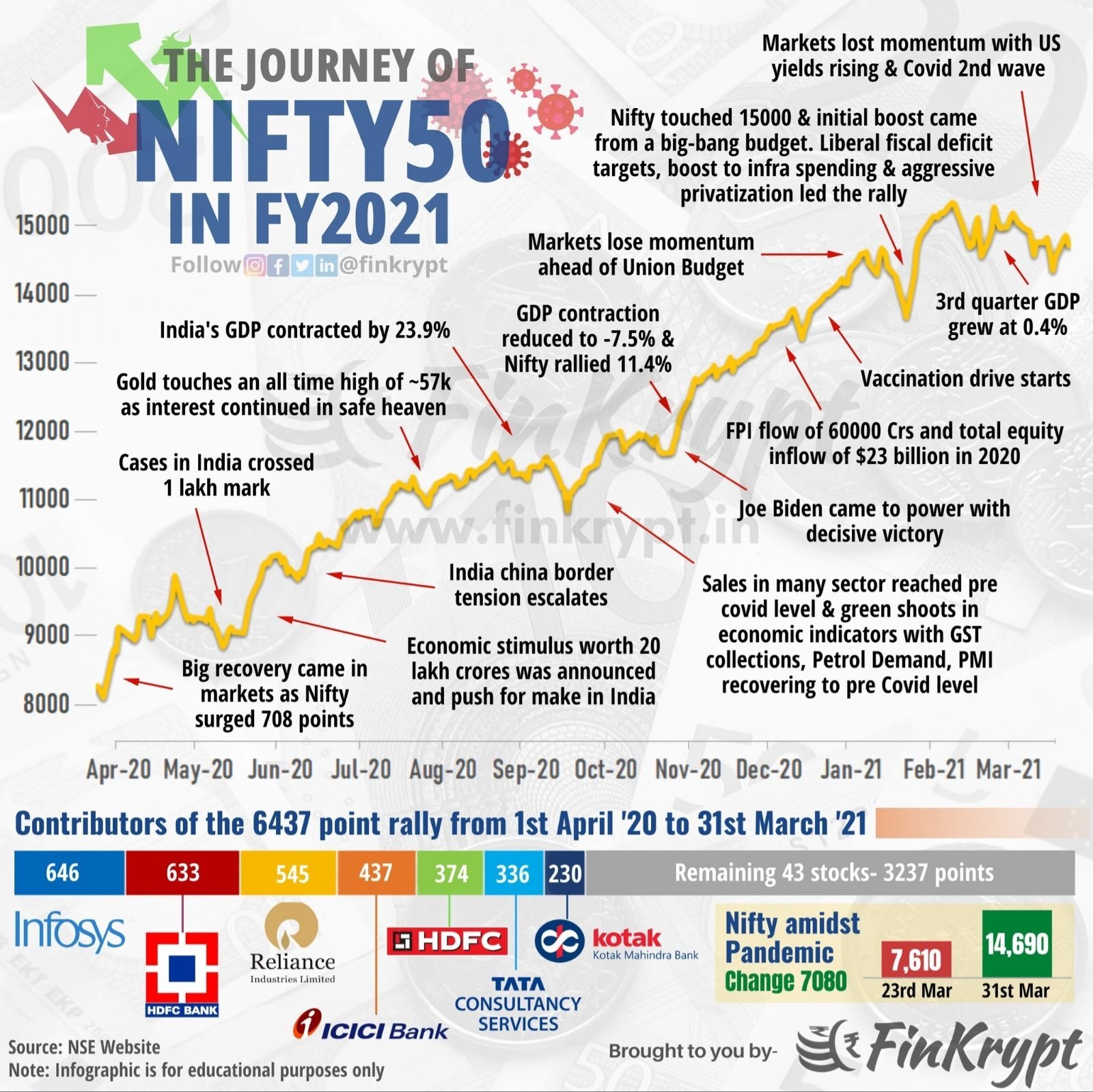

The S&P 500 climbed to a new high this week, while the Chicago VIX fell back to where it was before the pandemic. The Sensex again scaled 50K mark in a truncated week of trading. As we begin the new financial year, it is a good time to see how the markets peformed the past year.

This time, it’s not just liquidity that is leading to the surge —the fundamentals are catching up. Sample these headlines from the March Manufacturing Purchasing Managers Indices (PMI). For the US: ‘March PMI at second-highest on record’; UK: ‘UK Manufacturing PMI at decade high as growth of output, new orders and employment gather pace’; Eurozone: ‘Eurozone manufacturing sector expands at survey record rate in March’.

India’s manufacturing PMI will be published on Monday. It too should be robust! These numbers show that a strong global recovery is on track in the manufacturing sector in spite of a renewed wave of infections and fresh lockdowns in many regions. The second wave of infections continue to gather pace in threat and I’m hoping that India listens to medical experts and doesn’t do any all out lockdowns; we cant afford it and neither can the poor unorganized sector who bear the brunt of the same. Instead the focus should be on hastening the vaccination drive!! But are they listening??

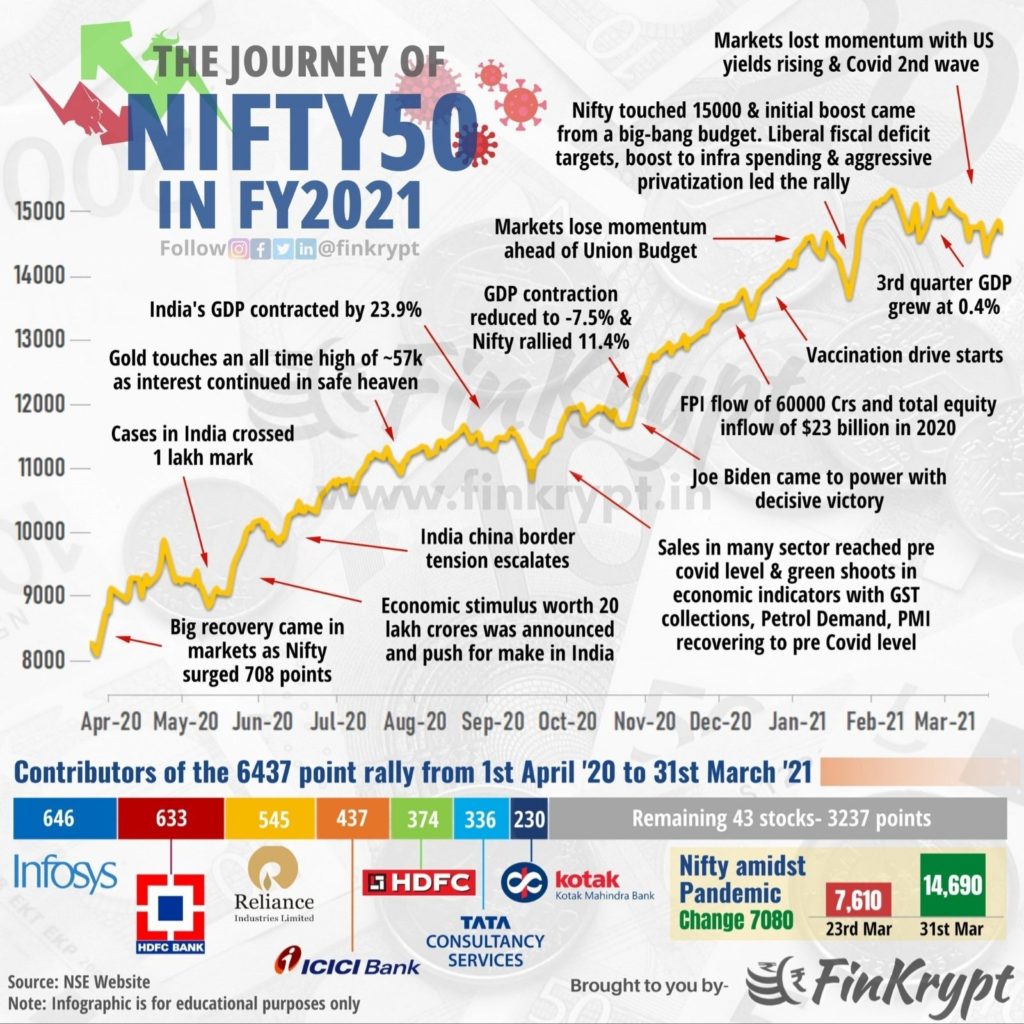

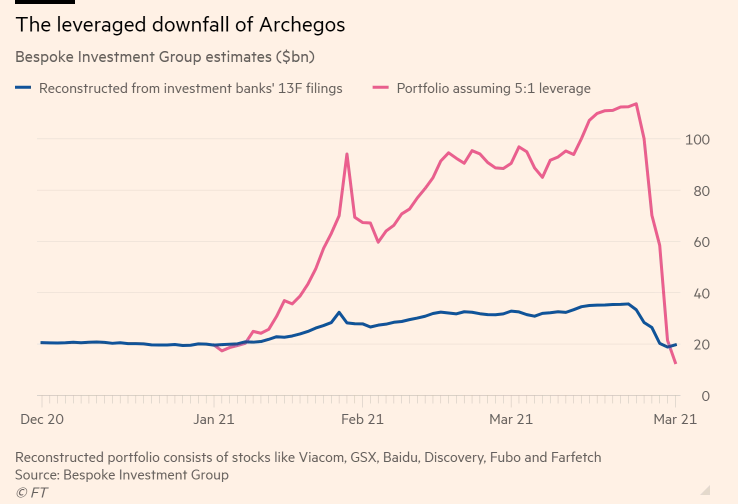

Archegos and the US$ 5-10Billion Loss

Archegos Capital Management is a family office, run by Mr Hwang (a once celebrated hedge fund manager) who was managing his own private wealth, running into a few billions. He was so convinced of his bets that he borrowed from banks against these shares!!

Like stocks do, 3 of his holdings’ started tumbling, and the banks holding these stocks as collateral wanted more protection and when Hwang refused to comply, the banks needed to find ways of getting their money back. Every banker dealing with Archegos was desperately trying to get rid of the collateral as soon as they found out Mr Hwang was ready to default on his obligations.

Nomura faces losses to the tune of $2 Billion while Credit Suisse said its losses would be highly significant and material to its results this quarter. Goldman Sachs and Morgan Stanley meanwhile stated that their losses would be immaterial.

If you want to read the detailed version, do take a look at https://finshots.in/archive/archegos-capital-debacle/

People are continuing to be reckless and greedy and pay a heavy price. As investors, we can only hope that this loss is restricted to a few banks and there is no contagion effect!!

Source: Moneycontrol & Finshots

Leave a Reply