Market Musings Week 4: Budget and GameStop

Indian markets corrected by 7% this week as expected. After all the markets have run up a lot as I have been writing regularly. Nifty fell by 1000 points and the Sensex fell 3000 points. This is just natural movements as people book profits prior to a key market event.

Our FM will present the Union Budget for 2021-22 on February 1 and this will be one of the most keenly watched budgets of recent past!! Expectations have also been further raised by her comments of “100 years of India wouldn’t have seen a Budget being made post-pandemic like this”.

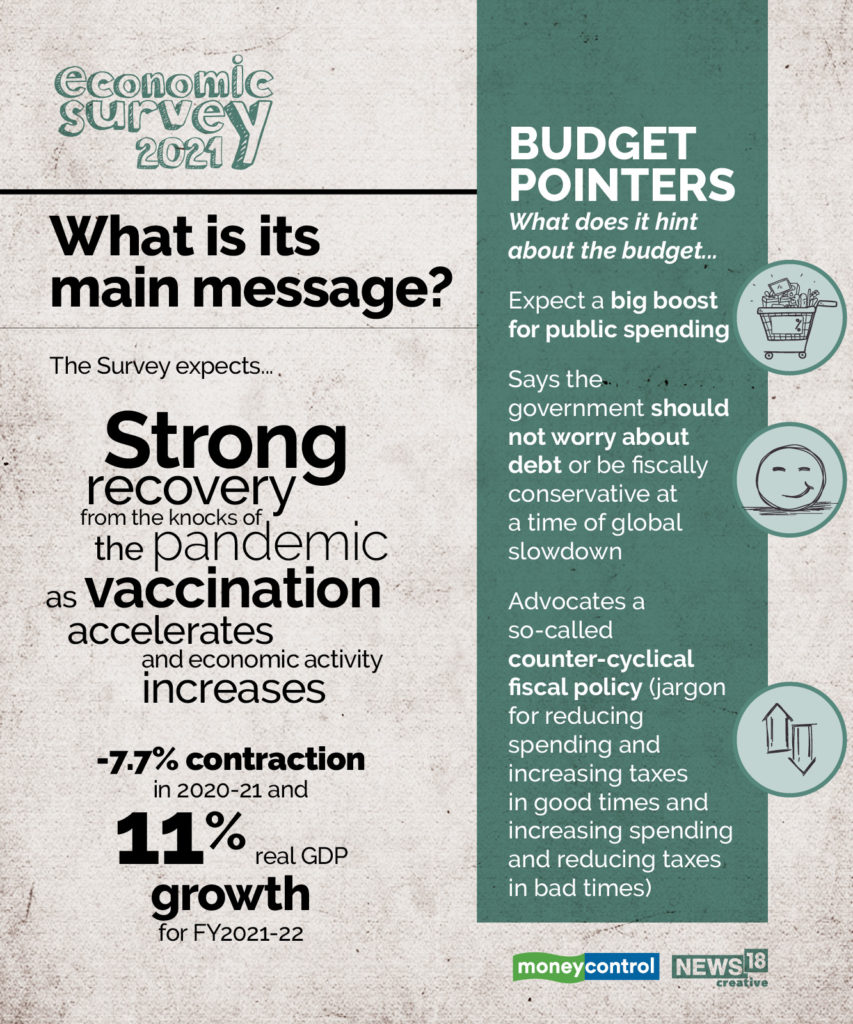

The Economic survey authored by CEA was released on January 29 and this gives us some key insights, captured very well in these two snapshots done by Moneycontrol.

3 Key Expectations from this Budget

- Fiscal Consolidation will, for the first time, not be our focus. Fiscal Deficit is at 5.5% and we are expected to reach 7%.

- What is the Govt going to do about Growth? How is it going to support private sector companies and how aggressively is it going to spend esp in Infrastructure? Credit flow and cash in hand of individuals key!!

- With falling GDP and revenues falling, how is the govt going to get revenues? What better time for reforms and disinvestments?

Recession due to a pandemic not seen in 100 years is surely the time to bat aggressively. Hope the govt will learn this Team C of the Indian cricket team!!

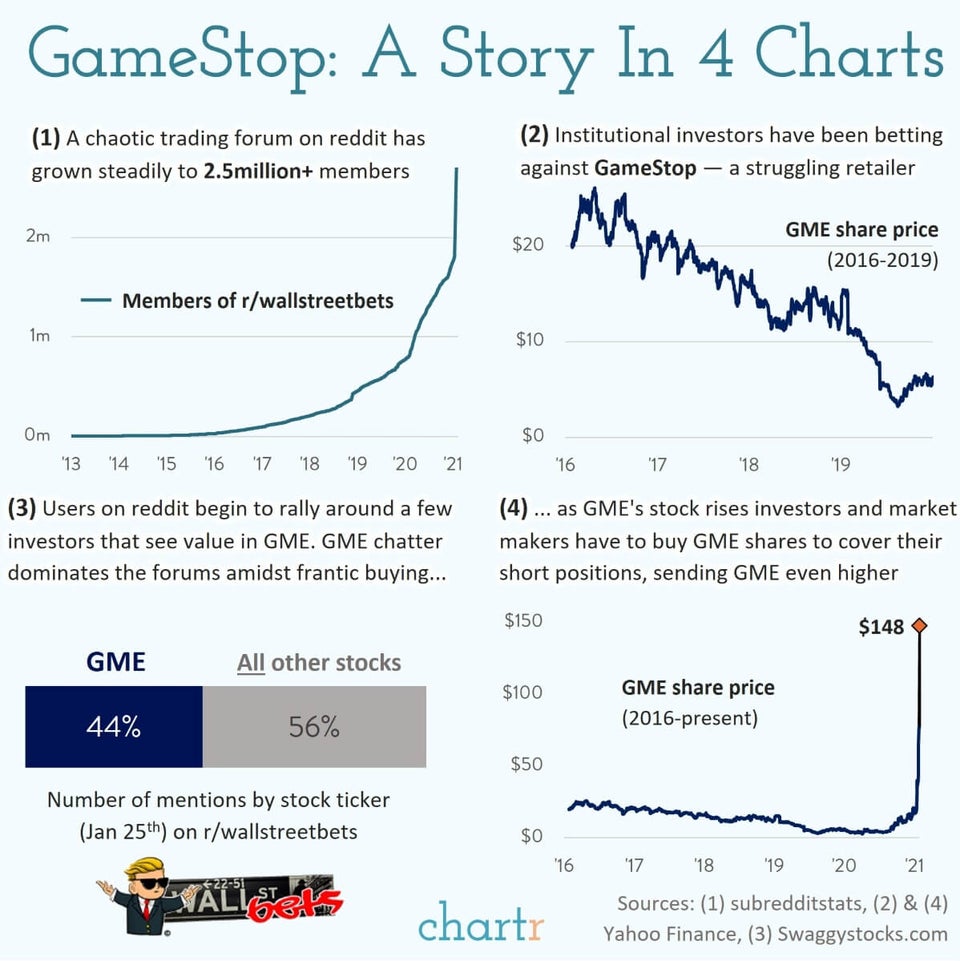

GameStop: David Vs Goliath

In one of my favourite books – David and Goliath, author Malcolm Gladwell talks about how Goliath, contrary to public perception, had NO chance against David. However, the analogy has stuck…so be it!!

As can only perhaps happen in the finance space, this week was all about GameStop (GME) – a stock most of us have not heard of but it went up from a paltry US$ 20 to US$ 325 in just 1 month!! If you haven’t read about it here, please do…after all as these Reddit investors say “You only live once”!

My 2 cents on this saga …Valuations are very subjective and even the experts get it wrong!! Everyone is piling on and while some will make huge sums of money, many will lose. Until another YOLO trade comes along.

Source: Moneycontrol, Chartr

Leave a Reply