Market Musings Week 3 2021: Sensex Crosses 50000

21st day of the Year 21 of the 21st Century is very unique…read a whatsapp forward in the morning. I didn’t really appreciate the uniqueness till the markets opened…

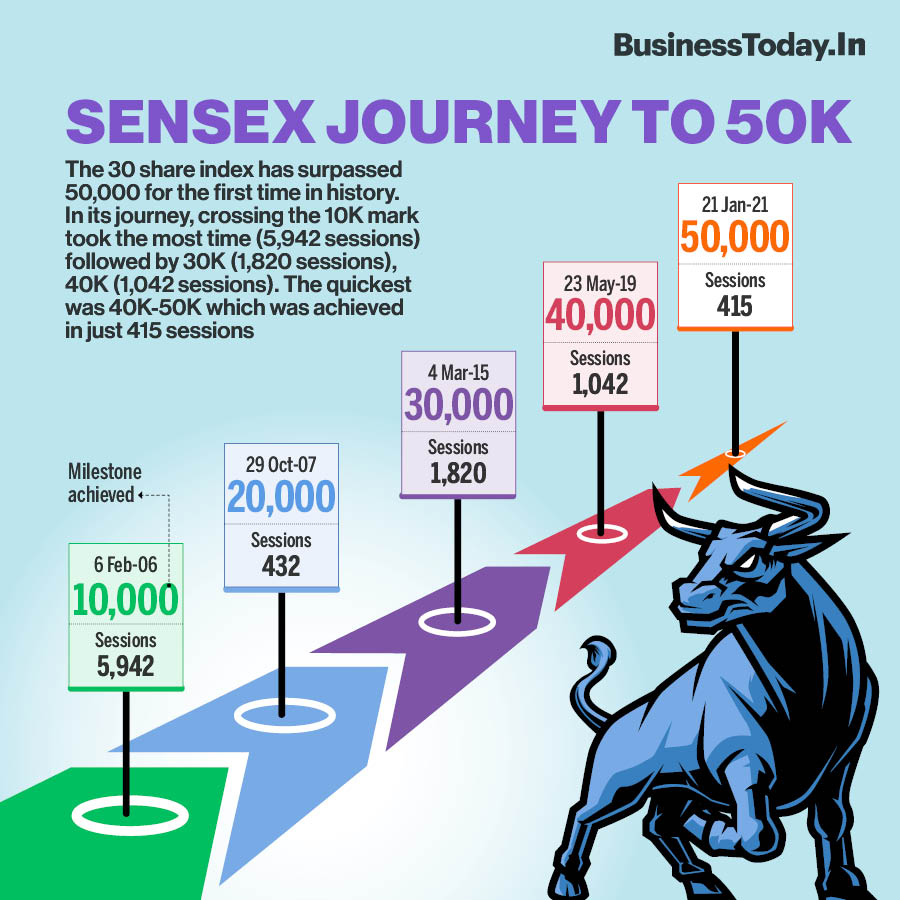

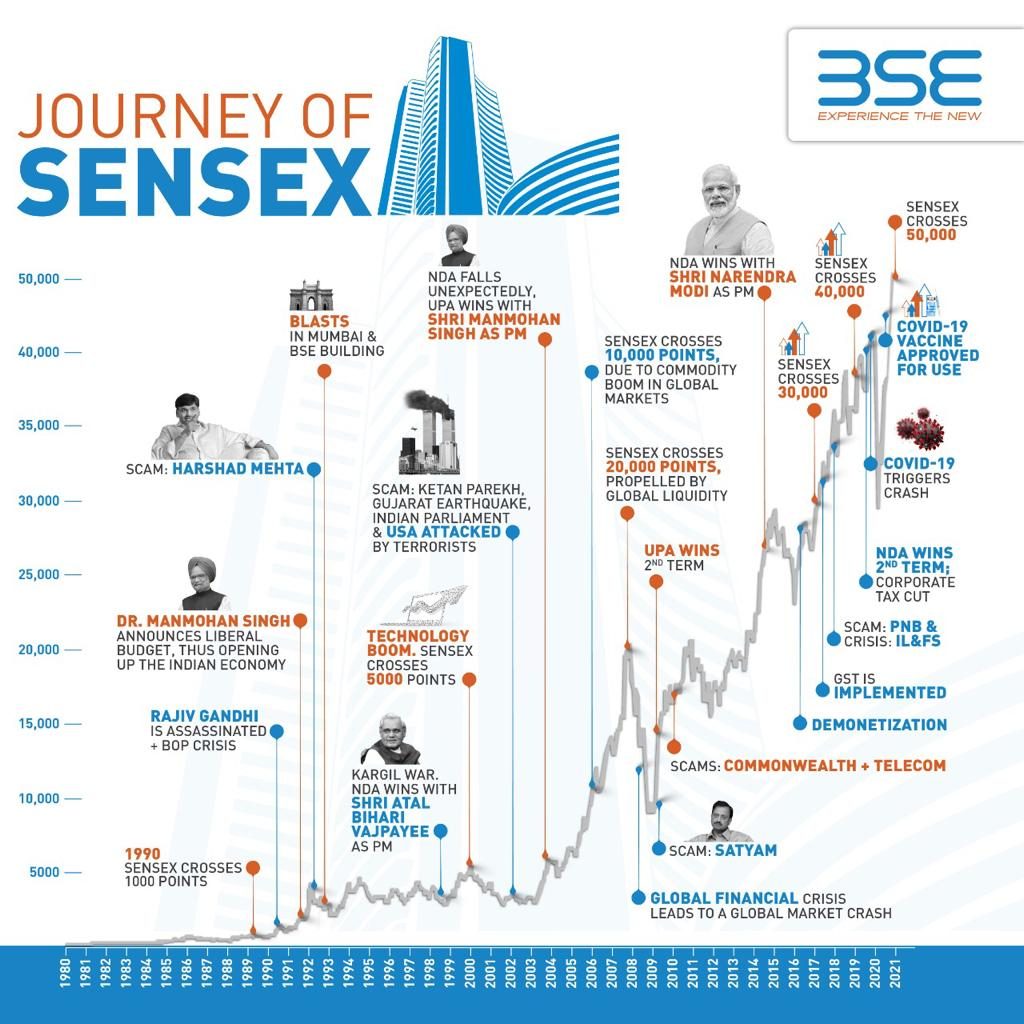

The BSE Sensex crossed 50,000 for the first time in history; it has doubled in just 9 months!!

The first 10K points gain was the fastest with the current run third best! It has taken lesser days but also has moved 25% from 40k to 50K!

This has primarily been a liquidity-driven rally with money chasing yields. Emerging markets are the favourites for Foreign Institutional Investors (FIIs) and the market goes from strength to strength. As this chart from Moneycontrol shows, FIIs sold Rs 65.8K Cr in first 3 months and bought twice as much in the last 3 months of 2020.

Focus on Asset Allocation

What does all this mean for individual investors? NOTHING!! Your money works towards only one thing – your goals!! If your goals are long term, then why concern yourself with all this noise.

We have never been good at predicting the markets; I know of a few “gurus” who panicked in March and exited their holdings and are waiting for a correction, even now!! This isn’t the first time and won’t be the last time.

“In a Bull market, get out of your Duds! In a Bear market, go after the ones you missed!!“

I recommend investors review 2 things:

- Asset Allocation – It is not about timing the market but Asset Allocation. To know more talk to us and read our perspectives at https://banconus.com/asset-allocation/

- Do an audit of your holdings, exit the duds and shift to high-quality funds/stocks.

Source: BSE, BusinessToday, Moneycontrol

#sensex50K #markets #banconus

Leave a Reply